I don’t talk about it much here, but I am an enthusiastic user of cryptocurrency. Yes, it’s full of scams, but the underlying technology has great potential, and companies like Lofty.ai (affiliate link) have shown how it can be used legally to benefit small investors and enterprises who currently are locked out of the real estate market.

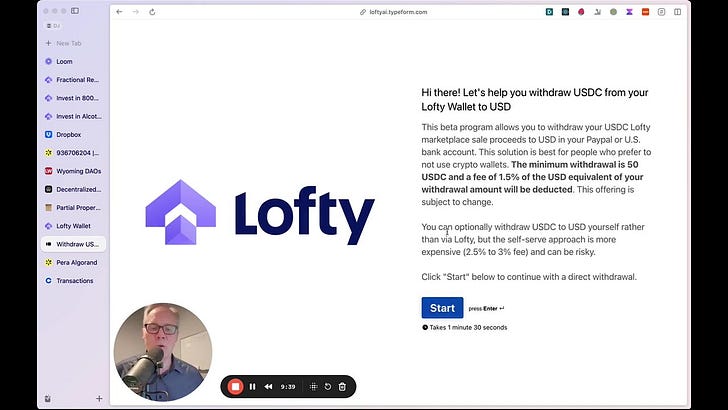

Here is a video of how I use Lofty with a fourplex I own in Denver.

Rep. French Hill from right here in Arkansas has been tapped to chair the House Financial Services committee. He is known to have a forward-looking stance on this issue.

Below is an letter I sent to his office outlining four areas where Congress can regulate and promote responsible use of the technology. These four principles are relatively simple to legislate and enforce. Done correctly, they will unlock low-cost investment opportunities for the average person while protecting them from scams.

Representative French Hill

1533 Longworth HOB

Washington, DC 20515

Dear Mr. Hill,

Congratulations on your re-election and on being named chair of the House Financial Services Committee.

I am a resident of Fayetteville and a longtime user and investor in cryptocurrency protocols. Though the industry is unfortunately rife with scams, the underlying technology has great potential for entrepreneurs and consumers. Sensible regulation can open up a world of opportunities and set the agenda for the entire world.

I have many ideas about this, but rather than bore you with a white paper, I will outline a few areas where Congress can make an impact.

Change the rules around what constitutes an accredited investor. Currently this definition is entirely determined by net worth and income. This may have made sense in the 1930s, but potential investors in the 21st century have many sources of education and due diligence available to them. An investor should be able attain accredited status via education, similar to the Series 7 license required of stockbrokers. The guidelines for competent investing can be learned and tested in a few weeks. Expanding the pool of available investors will make it easier for new businesses to get funding and create a larger crowd of educated people to provide advice and due diligence.

Develop guidelines for what a business that receives funding should do. As an owner of an apartment complex, I send monthly emails to investors breaking down our gross revenues, expenses and profits. While this isn’t mandatory, it’s a good practice that my investors have come to expect. They should expect that of all companies they invest in. Requiring it as a matter of law is overkill, but publishing it as a guideline and including it in investor accreditation as red/green flag to look for would set the right tone.

Embrace Decentralized Autonomous Organizations (DAOs) as a federally recognized operating entity. Currently the states of Wyoming, Vermont and Tennessee have formal rules for DAOs, and treat them as LLCs. I am a member of multiple DAOs organized under these laws, including one for a four plex I own in Denver. DAOs have great potential to attract, aggregate and allocate capital at a low cost with much higher transparency than the status quo with traditional private equity. Setting a standard here in the US would provide a benchmark for the entire world.

Create a path to federally recognizing certain forms of decentralized identity. “Know your customer” and “anti money laundering” laws are essential to preventing criminals from using banks and other financial services. However, the methods for doing this are cumbersome and require that each organization recreate the wheel every time. A decentralized identity system would allow a certifying organization to put its “stamp of approval” on an individual, making it easier for other businesses to comply, and for that individual's activities to be logged for compliance (while still protecting privacy).1 Furthermore, a decentralized identity could work across borders, allowing the free flow of capital from foreign investors but still compliant with FINCEN’s AML provisions. Again, by defining and embracing a standard, the US would lead the world in creating a safe but vibrant ecosystem for investors.

Thank you for your time and consideration on these issues. I am happy to speak with you if you are interested in hearing more about these ideas and how they can benefit Arkansas.

With warm regards,

Derek “DJ” Scruggs

Think of how many times you’ve had to produce an ID to do something in real life. To do that online, you have to take a selfie with your ID and submit it to the company that may not have the best security practices. A cryptographic identity allows you to prove who you say you are without giving out sensitive information.

Furthermore, other people and institutions can attach information to that identity. For example, proof that you graduated college, that you worked at a certain company, or even that your doctor prescribed a specific medication. This blog post gives many more examples